By the end of this lesson, you will:

In the previous lessons, you:

But even with a vig, you’re still exposed if someone places an unusually large bet.

🧮 Example: If another punter adds a $50 bet on Tails in your coin toss market,

your total liquidity becomes $250.

If Tails wins, you’ll need to pay out: 1.9 × $150 = $285

That’s a $35 loss, since:

Market Liquidity – Payout = $250 – $285 = -$35

🚨 That’s exactly what you’re trying to avoid as a bookmaker.

There are several ways to manage this risk, but the simplest is through Market Limits.

Bookmakers set a limit on how much a punter can place on a single bet. This is called the market limit. It’s the easiest way to prevent overexposure before it happens. Being “exposed” means there’s a chance you could lose money from your book if the wrong outcome wins. By setting a market limit, you control your maximum risk.

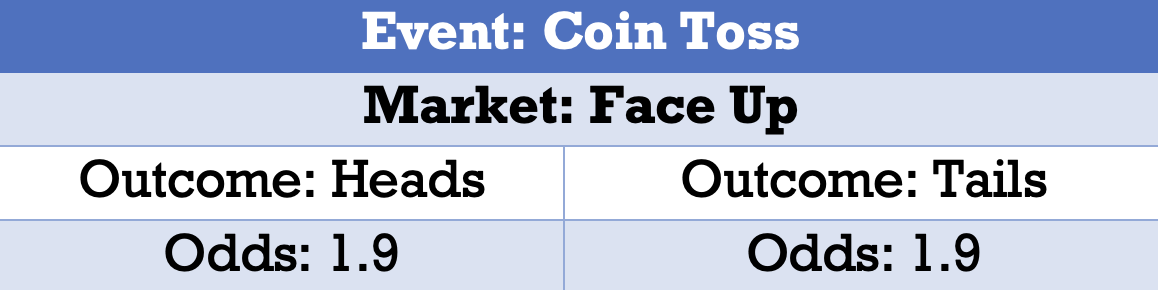

You already have:

Now, another punter wants to place a bet.

You want to guarantee a minimum profit of $6.50 from this market.

Remember:

✅ Based on that, you’ll set your market limit for the next bet at $4.

🎯 Even if Tails win, your profit drops slightly, but you’re still safe.

Compare this to owing $35 if you left the limit open!

✅ See how market limits protect 🛡️ the bookmaker.

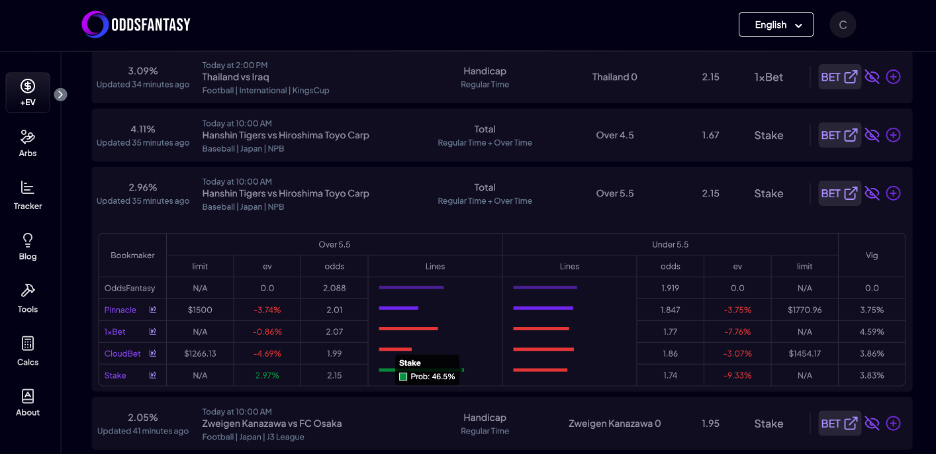

If you look closely at the image above 👆, you’ll see that Pinnacle has set a market limit on both outcomes of this market:

📈 Higher limits = more liquid markets

📉 Lower limits = less liquid markets

In the examples above, you set a small limit of $4 because:

If your market liquidity was $1,000,

Your 5% vig profit = $50,

So you might set a higher limit, maybe ensuring $40 profit minimum.

🔹 Pinnacle sets much higher limits because these markets have greater liquidity, often in the tens of thousands.

So when you see a market with a high limit, it usually means:

You can use this as a signal of how “healthy” or “active” a market is.

In the next lesson, you’ll learn about 📈 Line Movement. How and why odds shift over time. Understanding line movement will help you see: